Biz Tips: Opening the black box of offline marketing with data analytics

GROWTH:

Opening the black box of offline marketing with data analytics

The marketing communication industry has three main players: the brand, the agency and the media owner. The agency, who is typically the middle-man, has the most visibility in attribution and drives majority of the tactical decisions of the brand. Having said that, the agency does not have an economic interest to maintain transparency between the brand and the media owner. This is particularly a problem when it comes to offline marketing, like TV or billboards, where data is very difficult to collect even for the agency.

We believe that the wide availability of data will bring more transparency to the industry and secure the future of offline media. This will cause a significant change in how the players operate and the credibility of the industry.

The decline of offline marketing

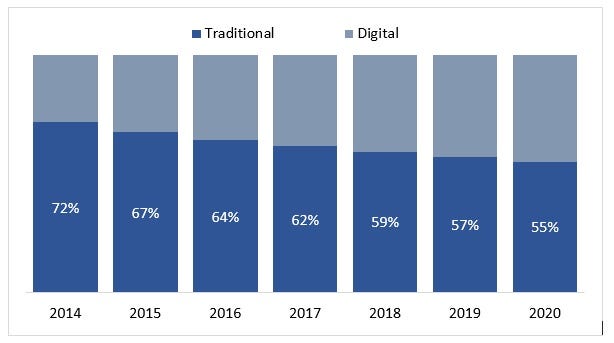

There has been a war raging between offline or traditional marketing and digital marketing since 2000 when Google launched AdWords. The traditional media spend has been decreasing steadily, hitting 60% in 2018. It is expected to continue declining.

While the perceived reason for this decline has been that digital marketing is better at reaching the target audience, however the deeper reason for this shift has been lack of data to prove the value of traditional media. When a brand manager spends USD 1M on a TV campaign versus Google AdWords: the amount of data available in Google AdWords is significantly more than the amount of data available from TV campaigns. It is this ability for brand managers to prove value to their superiors, that has led to decline of traditional media.

We firmly believe that traditional media scores better in some areas compared to digital media and our research focuses on procuring the data, insights and finally enabling brand managers to make decisions on traditional or offline media spending.

The scope of the problem is significant since majority of the companies spend 5% to 8% of their annual revenues on both offline and digital media. This translates to over USD 5 M a month in a company with USD 1 B in revenues. Depending on the country, the offline spend ranges from 40% to 70. This is over USD 3M per month spent on offline media in a USD 1 B dollar company. All this spending is done in the dark with very limited data.

Measuring return on investment of offline media spend is quite a challenge. We built attribution models for three offline media types — TV, OOH and POSM. An attribution model measures the return for each dollar spent on marketing. Digital marketing provides detailed attribution models. For example, Google Analytics provides this with a very high level of granularity. However, due to lack of data, attribution models are not straightforward in offline media.

Television (TV)

Brand managers have very limited information when deciding on the TV campaign modalities. Typically, they use Nielsen’s Gross Rating Points (GRP’s) or Target Rating Points (TRP’s) given to each TV programme telecasted. Rating points are a survey-based result for major programmes. In a country like India, with 200 M households with TV, the survey sample size is approximately 60,000. This represents 0.03% of sampling which is an insufficient sample size in the digital world. The results are also not granular enough to analyse, either by weekday or weekend, by city, and by time of the day. Utilizing data from vendors like Zapr, an Indian company, can help solve the problem. Zapr tracks the viewership behaviour by embedding SDK’s into partner apps and is collecting about 200 M data points per month in India in compliance with privacy and confidentiality regulations.